Life Insurance Commissions Explained: How Agents Get Paid

Demystifying Life Insurance Commissions, A Practical Guide for Consumers & Advisors

Life insurance commissions remain one of the most misunderstood aspects of the industry. Even financial professionals frequently have more questions than answers. Many individuals are unaware of how agents are compensated, which leads to widespread misconceptions. This overview aims to clarify commission structures, explain their variations across different products, and highlight the extensive work agents undertake to earn their income.

While this overview cannot cover every nuance, since commission structures vary by carrier and product, it will provide a clear, foundation for understanding revenue in the life insurance space. This will empower the reader the understand what questions to ask and nuances to look out for when shopping for life insurance solutions.

Captive vs. Independent Agents

The most significant differences in commission structures arise when comparing captive carriers (companies that employ agents directly) with brokerage carriers, which allow agents to operate independently in the open market.

Captive Agents

Captive agents typically earn lower first-year commissions, generally around 50%. However, they continue to receive renewal commissions for many years, sometimes up to 10 years, even on term insurance. This extended payment structure incentivizes loyalty and retention among employed agents.Independent Agents

Independent agents often earn higher first-year commissions, sometimes reaching 100% of the first-year target premium, but receive little to no renewal commissions. For term insurance, commissions are typically paid only in the first year, whereas permanent insurance may include small residual commissions (1–3%) after year one.

It is also important to note that in each of these structures, if an agent is working in a hierarchy under another agent or firm, they may be receiving even lower commission percents than stated here. This is due to the “upline” receiving the commission gross commission and paying their agents out of that revenue.

Permanent vs. Term Insurance

Commission structures vary not only by carrier but also by product type and design. The most notable differences are found between term insurance and the various forms of permanent insurance.

Term Insurance

Term policies are straightforward: coverage for a set period (10, 20, or 30 years) with fixed premiums. Commissions are typically based on the annual premium and paid only in the first year.Permanent Insurance

Permanent policies, such as whole life, universal life, and variable universal life, are more complex. They offer lifetime coverage and can accumulate cash value. Premiums can be structured in multiple ways:All-pay: Premiums paid every year for life.

Short-pay: Premiums paid in larger amounts over a shorter number of year, for example, 10 or 20-years, after which, not further premium should be necessary when products are designed and executed properly.

This flexibility introduces the concept of target premium, which is critical to understanding commissions.

Target Premium Explained

Target premium refers to the dollar amount a carrier uses to calculate commissions. For term insurance, the target premium typically aligns closely with the annual premium. For permanent insurance, the calculation is more nuanced and varies by carrier and product type. Agents are generally paid between 50–100% of the target premium. Lower percentages are common in hierarchical or captive structures, or when a broker-dealer takes a portion of the commission. Higher percentages are typical for brokerage-style permanent products.

How is target premium determined?

This number comes directly from a formulated calculation by the carrier. The mathematical calculation is not disclosed but the target premium is almost always stated in the illustration paperwork.

Target premium is generally calculated based on the death benefit, not the premium contribution.

This is one of the factors when designing an investment product, the death benefit should be low relative to the need for total insurance. The higher the death benefit the higher the costs, including the cost of commission paid to the agent.

Target premium reflects more closely to an all-pay structure relative to premium dollar amount, not a short-pay schedule.

If a client pays for a permanent plan in 10 years instead of over their lifetime, the agent does not necessarily earn more commission because the client pays more upfront.

This matters most when permanent insurance is used as an investment vehicle. Clients may contribute significantly more than required to build cash value. In these cases, agents earn only small bonuses (1–3%) on excess premium beyond target.

Where to Find Target Premium

On policy illustrations, target premium is often noted in the following places so with this insight this number can be located.

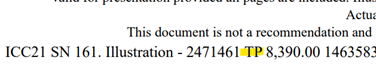

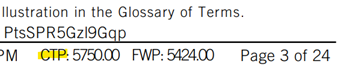

A small code at the bottom of a pages in the illustration, possibly only on the summary/signature page.

TP for Target Premium, coded at the bottom page of an illustration.

CTP for Commissionable Target Premium, coded at the bottom page of an illustration.

On the premium summary page, sometimes clearly labeled.

Target Premium stated outright on a summary page of an illustration.

A quick Ctrl+F search for “Target Premium” or, more commonly, “TP” usually locates it. If it cannot be found this way, asking the agent or carrier should bring about clarity. The exception to this will most commonly be found with whole life products. These products do not have the same legal disclosure requirements as universal, indexed, or variable insurance products so their illustrations more often do not state target premium or fee structures. This makes comparing these products a lot more nuanced.

Why It Matters

If one policy shows a substantially higher target premium, be cautious. Higher commissions can correlate with higher policy fees, which may not align with your goals. With all of this being said, the implication is not that agents do not deserve their income, commissions are often their only source of revenue, and the work behind each case is extensive. But understanding these structures helps you make informed decisions.

The Work Behind the Commission

Insurance agents, particularly independent brokers, rarely earn a salary; their income is entirely commission-based, which creates pressure to acquire new clients. This reality may explain why some agents employ aggressive sales tactics. While discussions about the necessity of insurance are important, if urgency or pressure tactics are present, they may be influenced by commission incentives.

With that, earning commission involves far more work than just selling a policy. Here’s what happens behind the scenes:

Underwriting Challenges

Underwriting is the ultimate gatekeeper. It determines whether coverage is approved and at what cost. Agents must:

Gather medical records and financial documentation.

Coordinate health exams.

Communicate extensively with underwriters and clients to make sure all information is provided. This can be lengthy and require a lot of attention especially when extensive additional information is necessary. There are many phone calls and emails to track throughout the process.

Given all of that, even after weeks, and sometimes months, of work, a case can be declined, resulting in zero revenue for the agent despite significant effort. Additionally, when a case is rated at a different level than applied for, the agent has to regroup with clients to determine the new costs impacts on the coverage they wish to take. This too can result in not accepting the rate and coverage, thus, no commission, or they can take substantially less coverage and this too reduces the revenue to the agent.

Again, none of this is meant to be sympathetic to insurance agents and their income structure, but rather provide some behind the scenes insight to the perspective of the amount of commission associated with a case.

Case Management

Managing an insurance case is akin to project management; without effective case management, the process can become lengthy and challenging. Case managers assist with the following tasks:

Scheduling exams.

Tracking medical record requests.

Following up with carriers and brokers.

Reviewing and approving paperwork for policy issuance.

Ensuring premiums are paid and coverage is activated.

An “easy” case might take a few hours. A complex case can involve dozens of touchpoints and weeks of coordination.

The Role of Brokers

Independent agents often cannot contract directly with carriers. They rely on Brokerage General Agencies (BGAs) or Field Marketing Organization (FMOs) for access to products and carriers. These brokers provide:

Contracting and appointment services.

Case management support.

Technology tools and software.

But brokers also share in the commission, this is how they are able to provide the tools and resources they have for agents. They are paid directly from a carrier in addition to the agent receiving commission. Their commission too is based off of target premiums and their respective percent of revenue based off of each individual product and carrier.

With that, on one insurance policy, an insurance carrier will pay well over 100% of revenue for that first-year target premium. This may sound absurd to pay out 140% of revenue to the producers in this process, but remember, the carrier gets paid premium every month, quarter, or year, that these policies are in place while the producers are only paid in the first year. They must compete for business and paying commission is part of that process.

Total Commission paid on a policy = approximately 140%

From that, here’s a typical breakdown of the brokerage space and their respective revenue:

IMO: ~10%

BGA: 30–40%

Agent: Remaining ~95%

Strong brokerage relationships are critical; they can make or break an agent’s success.

Summary

Life insurance commissions are complex and influenced by carrier type, product design, and premium structure. Understanding target premium, the distinctions between term and permanent insurance, and the role of brokers enables consumers and advisors to make informed decisions.

If you’re shopping for insurance or advising clients, knowing these details ensures transparency and confidence in the process.

Have Questions?

Reach out anytime to discuss commission structures or review your insurance options.

About Kusmider Consulting

As a full-service, independent brokerage based in Houston, Texas and available throughout the U.S., we specialize in aligning insurance solutions with broader financial strategies. We provide expert guidance, unbiased product recommendations, and ongoing policy oversight to ensure your coverage evolves with your needs.

Whether you're reviewing your own protection or advising clients, we’re committed to helping you make informed, confident decisions.